Estimated payroll tax calculator

The calculator includes options for estimating Federal Social Security and Medicare Tax. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. 2020 is not used to calculate the. For example if an employee earns 1500 per week the individuals annual.

After You Use the Estimator. Salary Paycheck and Payroll Calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This number is the gross pay per pay period. It only takes a few seconds to. Both you and your employee will be taxed 62 up to 788640 each with the current wage base.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. Or keep the same amount. Ad Process Payroll Faster Easier With ADP Payroll.

All Services Backed by Tax Guarantee. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Calculating paychecks and need some help.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use your estimate to change your tax withholding amount on Form W-4. Employers can use it to calculate net pay and figure out how.

All Services Backed by Tax Guarantee. Ad Process Payroll Faster Easier With ADP Payroll. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Free Unbiased Reviews Top Picks. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. To change your tax withholding amount. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Ad Compare This Years Top 5 Free Payroll Software. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Free Unbiased Reviews Top Picks.

Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings. Get Started With ADP Payroll. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. What does eSmart Paychecks FREE Payroll Calculator do.

Your household income location filing status and number of personal. If you receive a paycheck the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck. Free salary hourly and more paycheck calculators.

Get Started With ADP Payroll. Your employees FICA contributions should be deducted from their wages. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this.

Ad Compare This Years Top 5 Free Payroll Software. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Get an accurate picture of the employees gross pay. Subtract any deductions and. Ad Payroll So Easy You Can Set It Up Run It Yourself.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Payroll Tax Calculator For Employers Gusto

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

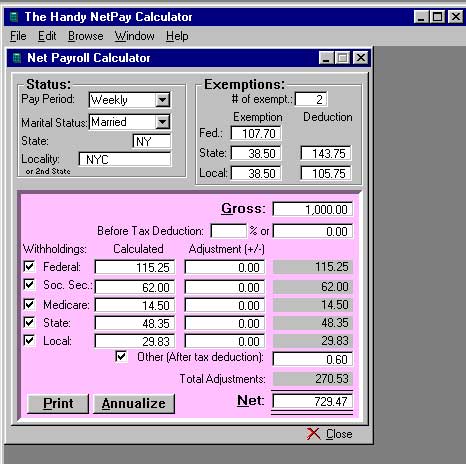

W 2 1099 Filer Software Net Pr Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

Enerpize The Ultimate Cheat Sheet On Payroll

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

Calculation Of Federal Employment Taxes Payroll Services

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Take Home Pay Calculator